Easton Motors: Your Trusted Used Car Dealer in Wisconsin

At Easton Motors, we understand that purchasing a car at an affordable price can be challenging, especially if you have bad credit. That’s why we specialize in providing in-house financing options to help you get the vehicle you need, without the hassle of dealing with traditional lenders or banks.

Understanding In-House Financing

In-house auto financing refers to loans provided directly from a dealership to a customer, without involving another lender or bank. This financing option offers several advantages, especially if you have bad credit. When you apply for an in-house loan, you’ll quickly find out your loan amount, giving you peace of mind that your loan isn’t being shopped around to multiple banks. This is crucial for protecting your credit score.

In-House Financing Breakdown

In-house financing works when a car dealership processes your loan internally through their own finance company, rather than relying on an outside bank. This option is particularly beneficial for individuals who have been unable to secure financing through traditional new car dealerships, banks, or credit unions. The dealership will review your loan application with their underwriters and provide final approval or rejection internally. Once approved, you are free to choose a vehicle from the dealership that fits within your loan amount.

Bad Credit? No Problem!

In-house financing is ideal for those with bad credit, people recovering from bankruptcy or divorce, individuals who have experienced vehicle repossession, those facing large medical bills, or even those with no credit history at all. With in-house financing, you’ll quickly find out whether you’ll be approved for financing and the loan amount you qualify for.

How Does In-House Financing Work?

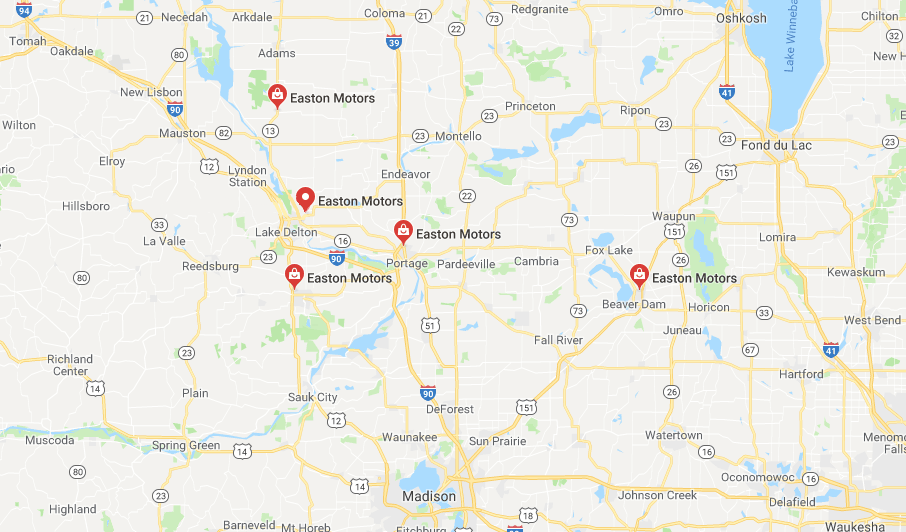

While the process may vary from dealership to dealership, at Easton Motors, our in-house auto financing is straightforward. When you fill out our online credit pre-approval form or visit one of our dealerships, we’ll use the information you provide as the starting point for getting you approved. In addition to considering your income, we take into account factors such as your housing situation, personal references, employment status, and yes, your credit score. Unlike other dealerships, we understand that credit scores don’t define your ability to make payments, so we approve loans on a case-by-case basis.

Once approved, our in-house financing amount determines the vehicles you qualify for. We’ll show you the range of cars, trucks, or SUVs that fall within your loan amount and take you for test drives.

If you think working with a dealer that provides its own financing is the right choice for you, contact us or complete our simple credit pre-approval form to start your journey towards finding the perfect vehicle and financial package.

FAQs

Q: Can I get approved for in-house financing with bad credit?

A: Yes! In-house financing is designed for individuals with bad credit, helping them secure the financing they need to purchase a car.

Q: Will applying for in-house financing affect my credit score?

A: Applying for in-house financing typically results in a soft credit inquiry, which does not have a significant impact on your credit score.

Q: Can I choose any vehicle with in-house financing?

A: The vehicle options available to you will depend on your approved loan amount. Our friendly team will help you explore the options that fall within your budget.

Q: What if I have no credit history at all?

A: In-house financing is a great option for individuals with no credit history, as it provides an opportunity to establish credit while purchasing a reliable vehicle.

Conclusion

At Easton Motors, we believe that everyone deserves a chance to own a quality vehicle, regardless of their credit history. With our in-house financing options, you can drive away with confidence, knowing that you have secured the best possible auto loan. Take the first step towards your new car by contacting us or filling out our simple credit pre-approval form today.